stock option tax calculator canada

Subsection 110 1 of the Income Tax Act allows the employee to report only half of the benefit derived from exercising the employee stock option. The Stock Option Plan specifies the total number of shares in the option pool.

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Treatment under current law.

. Enter the purchase price per share the selling price per share. Taxable benefit When a corporation agrees to sell or issue its shares to an employee or when a mutual fund trust grants options to an employee to acquire trust units the employee may. So if you have 100 shares youll spend 2000 but receive a value of 3000.

50 of the value of any capital gains are taxable. Equity based compensation is used by companies in both the United States and Canada. The Stock Calculator is very simple to use.

Enter the commission fees for buying and selling stocks. How much are your stock options worth. This benefit should be reported on the T4 slip issued by your employer.

Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional. Poor Mans Covered Call calculator addedPMCC Calculator. Exercising your non-qualified stock options triggers a tax.

Considering certain conditions are met you can claim a deduction equal to 50 of the stock benefit. 1 received common shares upon exercising the employee stock option. Deduct CPP contributions and income tax.

The tax treatment of equity based compensation can vary widely depending on the treatment in. This Tax Insights discusses the new employee stock option rules and answers some common questions on the topic. The taxable benefit is the difference between the price you paid for the shares the strike price and their value on the date of exercise.

The Stock Option Plan was approved by the stockholders of the grantor within 12 months. On the whole the CRA is concerned more with how and why you are trading than what it is you are buying and selling. Option grants that qualify for stock option deduction.

Just follow the 5 easy steps below. Find the best spreads and short options Our Option Finder tool now supports selecting long or short options and debit or credit spreadsTry it out. The Stock Option Plan.

Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. Will currency and stock trading taxes in Canada be the same as futures and options trading taxes for example. Calculate my AMT Reduce my AMT - ISO Planner.

Nil Note 1 C920000. If your options were issued and certain. This Tax Insights discusses the new employee stock option rules and answers some common questions on the topic.

The stock options were granted pursuant to an official employer Stock Option Plan. Please enter your option information below to see your potential savings. Stock option plans and employee stock purchase plans provide additional flexibility to attract employees and to encourage loyalty to the company.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Abbreviated Model_Option Exercise_v1 -. By including this 10000 on your tax return you could deduct 5000.

The employees benefit inclusion is 20 10 10. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions. The tax calculator is updated yearly once the federal government has released the years income tax rates.

You will only need to pay the greater of either your Federal Income Tax or your AMT Tax Owed so try to be as detailed and accurate as possible. You will face tax on the 10000 benefit this is where the idea of stock options should be of interest to you. Therefore futures tax reporting will face the same procedure and implications as a tax return on ETFs.

Thus making a stock option very tax-efficient. Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again. If you buy a share for 1000 and sell it for 2000 you.

Locate current stock prices by entering the ticker symbol. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. Under the employee stock option rules in the Income Tax Act employees who exercise stock options must pay tax on the difference between the value of the stock and the exercise price paid.

This calculator illustrates the tax benefits of exercising your stock options before IPO. For example the option price is 10 for 15 shares and the employee exercised the option when 15 shares were worth 20. When you exercise your employee stock options a taxable benefit will be calculated.

Stock option tax calculator canada. Ad Trade with the Options Platform Awarded for 7 Consecutive Years. Please select all that apply.

When determining the amount of the security option benefit subject to income tax withholding we will permit the employer to reduce the benefit by 50 using the Security options deduction under paragraph 110 1 d. IV is now based on the stocks market. The calculator will show your tax savings when you vary your RRSP contribution amount.

Option grants that do not qualify for stock option deduction. Youll pay capital gains tax in Canada on the difference when you buy a share and then sell it for a higher price. Important Note on Calculator.

Option grants that qualify for stock option. Total taxable income in year of exercise. Cash Secured Put calculator addedCSP Calculator.

Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share. This calculator illustrates the tax benefits of exercising your stock options before IPO. Enter the number of shares purchased.

This capital gains tax reduction doesnt apply for day traders who pay 100 tax on income from capital gains. You will face tax on the 10000 benefit this is where the idea of stock options should be of interest to you. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Under paragraph 1101d of the Income Tax Act employees of a CCPC may deduct one half of the employee stock option benefit when computing their taxable income if the employee. That means youve made 10 per share. Support for Canadian MX options Read more.

2 deals with the CCPC at an arms length and 3 the employee stock option price including any amount. Taxes for Non-Qualified Stock Options. Abbreviated Model_Option Exercise_v1 - Pagos.

Stock option plan This plan allows the employee to purchase shares of the employers company or of a non-arms length company at a pre-determined price. This permalink creates a unique url for this online calculator with your saved information. Report a problem or mistake on this page.

Under the current employee stock option rules in the Income Tax Act employees who exercise stock options must pay tax on the difference between the value of the stock and the exercise price paid.

Canada Annual Capital Gains Tax Calculator 2022 23 Salary

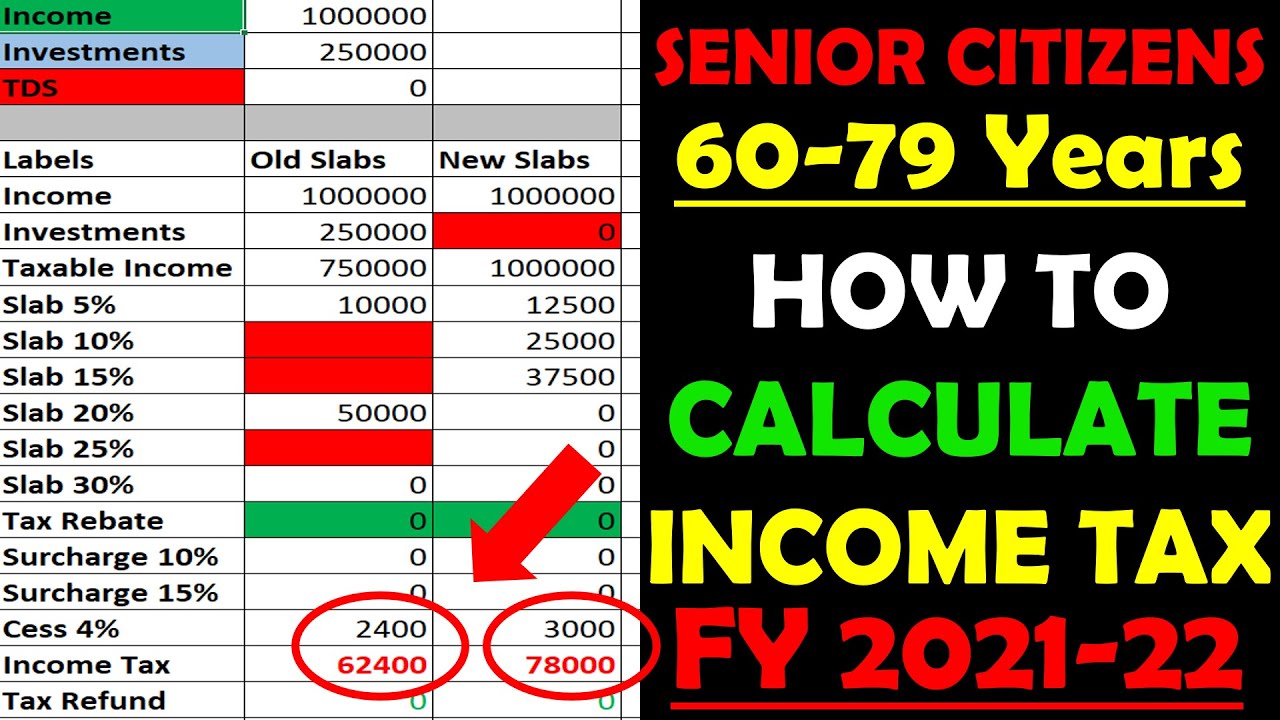

Income Tax Calculation Senior Citizens 2020 21 How To Calculate Income Tax Senior Citizens 2020 Youtube

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Taxtips Ca 2021 And 2022 Quebec Investment Income Tax Calculator

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Management Rental Property Income Property

Capital Gains Tax Calculator For Relative Value Investing

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Taxtips Ca Cpp Retirement Pension Calculator Information Page Retirement Pension Calculator Retirement

Capital Gains Tax Calculator 2022 Casaplorer

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

The Free And Easy Way To Calculate Acb And And Track Capital Gains

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Land Transfer Tax Calculator A Strong Option To Get Home With Land Transfer Tax Basic Facts Life Facts Transfer

Land Transfer Tax In Ontario Ratehub Ca

Income Tax Calculation Senior Citizens 2020 21 How To Calculate Income Tax Senior Citizens 2020 Youtube